IDC MarketScape Report

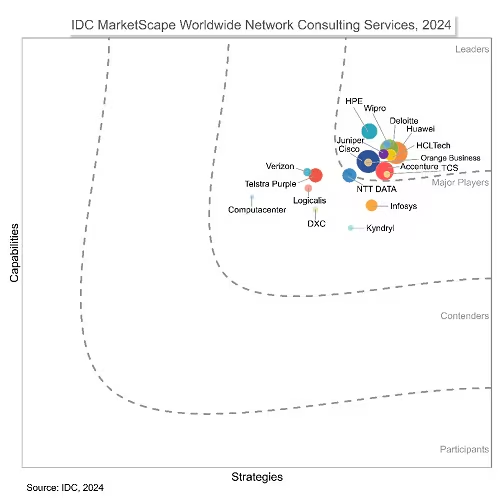

IDC MarketScape: Worldwide Network Consulting Services 2024 Vendor Assessment was published by a leading industry consulting business worldwide. In the competitiveness assessment based on ICT services and software capabilities, Huawei was placed in the “Leaders” quadrant due to its superior end-to-end network consulting capabilities.

For this IDC MarketScape, IDC MarketScape gathered and examined information on eighteen network equipment vendors, global systems integrators (GSIs), and global telecommunications providers. In order to give clients in the ICT infrastructure industry a market reference, it carried out an assessment of strategies and capabilities. Because Huawei was positioned in the “Leaders” quadrant, reputable third-party review organisations have acknowledged the network consulting skills of Huawei’s ICT services and software.

According to IDC, Huawei’s ICT services and software have a robust product portfolio, a global service organisation, and ongoing investments in the development of proprietary tools and platforms. These enable the company to offer end-to-end consulting services, such as network design, capacity planning, O&M transformation, and network optimisation. Additionally, Huawei has partnered with top business consulting companies to offer its clients vertical expertise to support their digital intelligence transition. The business has been in the ICT industry for more than 30 years.

Intelligent Connectivity Integration

Coordinates the development of 2C/2H/2B services and designs and constructs durable, green target networks for clients.

Intelligent IT Integration

Huawei offers full-stack integration services to its clients, which encompass facility and data centre IT services. The process includes consultation and planning, integration implementation, and auxiliary operation. This allows Huawei to construct intelligent, dependable, and environmentally friendly data centres for its clients.

Intelligent Operations

Service-centric intelligent operations and maintenance (O&M) helps clients reduce service disruptions brought on by network issues and enhances user satisfaction.

SmartCare

Using artificial intelligence (AI) and digital twin technologies in a novel way, create networks with optimal performance and service experience, assisting operators in enhancing the value of their network brands.

Huawei Learning

Huawei Learning provides systematic talent development services that include talent planning, talent cultivation, talent assessment, and operation to build talent for digital intelligence. The company’s expertise in talent cultivation dates back more than 30 years.

Business and network consulting

Grounded in industry expertise and worldwide best practices; comprehend client strategy; pinpoint critical vulnerabilities and high-value use cases; develop AI tools; foster collaboration between business and network; assist client business success through digital transformation; provide DICT planning and operation consulting services.

IDC VENDOR INCLUSION CRITERIA MARKETSCAPE

The market for network consulting services is constantly changing, so it will be helpful for tech buyers to know where the participants are going in terms of direction. Overall, the participating firms did quite well on this assessment, as one would anticipate from industry leaders, as the services firms were chosen based on their compliance with the necessary requirements.

It is crucial to recognise that, despite the market’s maturity, it is still very competitive, and the players in it are still making significant investments to offer outstanding technological know-how, resources, and tools for consistency and innovation, as well as consultants who can provide strategic advice to help clients transition as smoothly and safely as possible from their current “as is” environment to the new “to be” state.

IDC MarketScape gathered and examined information on eighteen network equipment suppliers, global systems integrators (GSIs), and global telecommunications companies for its IDC MarketScape assessment of global network consulting services. IDC MarketScape used the following set of inclusion criteria to choose which players to analyse in the IDC MarketScape:

Global scale:

With operations in three of the four regions of North America, Latin America, EMEA, and APAC, the corporation is a worldwide player.

Revenue

Revenue is $40 million.

Network consulting services offering

Network consulting services are offered, including strategy, planning, assessment, design, adoption, and optimisation, across a wide range of network solutions.

- Datacenter networking, SD-WAN, hybrid WAN, multicloud, SDN, NFV, network virtualization, edge networking, and IoT

- Networking on campuses Wired and wireless networking

- Not Included

- Managed services, support services, and installation services are not covered in this study. Although IDC MarketScape considers these services to be essential parts of the life cycle, the evaluation in this study will only concentrate on network consulting services or the “plan and build” stages of the life cycle.

TECHNOLOGY BUYERS’ ADVICE

More than ever, networks are a vital part of the investment in IT infrastructure today. Therefore, before proceeding with an engagement, technology buyers need to have a comprehensive understanding of six fundamental components regarding their networking consulting services partner, according to IDC. The purpose of this IDC MarketScape study is to help technology purchasers by offering information on these essential components of a provider’s services offering. Additionally:

Provide depth and breadth

Development of thought leadership, a unique perspective, and a relevant ecosystem of partners; ongoing offer development and refinement in line with emerging technologies and paradigms;

Global scale

Capability to provide consistency globally while accommodating local customisation, cultural, and linguistic requirements; project management, knowledge-sharing, and collaboration tools to ensure efficient global coordination

People

Constant investment in high degrees of technical proficiency in all networking technologies; best practices in hiring and retention with an emphasis on excellence and client satisfaction

Repeatable processes and delivery methodologies

The capacity to exhibit repeatability while concurrently constantly refining processes to increase effectiveness, value, and insights

Investments in tools and platforms

Showcase investments in cutting-edge technologies and tools, including automation, machine learning (ML), artificial intelligence (AI), and platforms, to improve user experience, boost network insights, expedite service delivery, and eliminate labor-intensive manual tasks.

Adoption and optimisation

To guarantee the effective adoption and optimisation of new technologies, formalised customer success teams and actions are implemented throughout the project life cycle.

Dynamics of Network Markets

It is crucial to remember that the network market is dynamic and that service offers and portfolio expansions are impacted by new operating paradigms and technology. A few significant industry trends that may affect the market for network consulting services or solution offerings are highlighted by IDC MarketScape.

Integration and Mergers

Consolidation of the networking business is a recent trend. The push to commercialise AI capabilities and the growth of networking portfolios into security and observability are the two primary themes propelling this consolidation. Clients of these businesses should be aware of this trend since it can significantly impact the survival or lack thereof of vital products as well as expert and managed services.

The truth is that not every employee from each of the two or more companies stays together after they merge. Delivery of goods and services could be negatively hampered, which would affect current business and operational ties. In order to lessen the potential negative impacts of mergers and acquisitions (M&A), networking clients should build and preserve connections with key account managers for each supplier they use.

The Ascension of Hyperscalers into Network Consulting Service Providers

In this market, the hyperscalers have an intriguing position. On the one hand, in contrast to, say, a systems integrator with a robust networking business, they do not specifically focus on network consulting and integration. Still, they offer prepackaged connectivity options for establishing connections to their public clouds. In actuality, their primary focus is cloud data monetization; hence, low-margin, labor-intensive industries like integration and consultancy make little sense. Therefore, it should come as no surprise that the majority of hyper scalers have comparatively small professional services organisations that prioritise scalable designs and blueprints.

Meanwhile, according to Huawei’s survey, businesses view hyperscalers as a major supplier of network consulting and integration services, or more precisely, connectivity solutions to the cloud, with the ability to self-procure or obtain these services from a partner.

Huawei interpret this as indicating not only the significant mindshare that these companies currently possess, but also the potential for non-hyper scalers to intensify their own message within this domain.

Furthermore, it highlights the potential revenue stream for hyperscalers in the event that they choose to refocus their monetization efforts from “data in clouds” to “moving data from andbetween clouds,” consultancy, and integration.

If that were the case, businesses would already be interested in learning about their value proposition. Please be aware that this IDC MarketScape study has not previously assessed them.

AI’s Effect on the Provision of Services

IDC MarketScape sees services for AI and AI for services as two distinct focus areas as AI becomes more commonplace in the industry. Regarding the latter, it is crucial to remember that the industry for services delivery is not new to improved intelligence; network probes and analytics apps are widely used. Huawei do, however, detect a few noteworthy extra dimensions.

First, AI for services delivery is already making an appearance in provider marketing narratives. While analytics and intelligence tools were once considered background features, AI for services delivery is now a focal point of demos and presentations. Second, by switching from people-centric to AI-enabled, human-governed operations, it has the potential to drastically alter the dynamics of the extremely competitive labour market for services. Although Huawei believe this may take longer to happen, it may help with some of the resource problems as well as skills shortages.