According to TrendForce: 2022 SSD shipments falls 10.7%

TrendForce’s latest study indicates that the lack of master control integrated circuits (MCIs) that had affected the global SSD market in 2021 was resolved, bringing the industry back to normal in 2022. SSD shipments worldwide decreased in 2022, falling to 114 million units, a 10.7% decrease from the previous year, despite the supply normalizing.

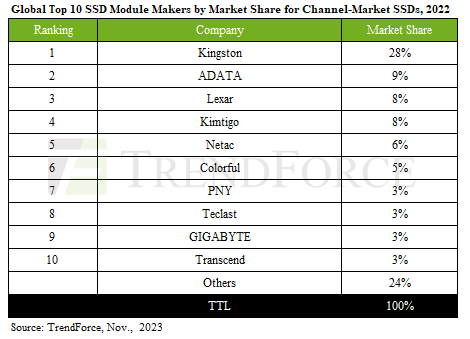

In 2022, Kingston, ADATA, and Lexar were the top threeSSD Shipments firms; in comparison to 2021, ADATA and Kingston maintained their significant advantages and saw rise in their market shares. An aggressive rise in sales in preparation of an IPO was credited with driving Lexar’s growth.

In 2022, Kimtigo achieved notable strides in its expansion into OEM and industrial control sectors, resulting in higher shipment volume and market share. In order to sustain its market share and ranking year over year, Netac obtained multiple government contracts in the enterprise SSD Shipments field and remained competitive in the SSD industry.

The top three manufacturers of SSD shipments in 2022 were ADATA, Lexar, and Kingston. ADATA continued to lead the market in 2021 and maintained a significant lead over Kingston. One reason for Lexar’s rise was its ambitious revenue-driven strategy in preparation for going public.

In 2022, Kimtigo achieved noteworthy progress in broadening its reach into OEM and industrial control markets, hence augmenting its shipment volume and market share. In addition to obtaining multiple government orders in the enterprise SSD space, Netac kept its competitive advantage in the SSD Shipments industry and maintained its market share and ranking from the previous year.

Further down the ranks, there were noticeable alterations. Vibrant, which took advantage of NAND Flash and China’s domestic master controls to cut costs, outpaced market trends by increasing shipments and moving up to the sixth position. Through intensive worldwide channel expansion, PNY was able to endure market downturns and regain its position in the top ten. Teclast moved up to the eighth spot while maintaining its market share from 2021.

In the end, Transcend held the tenth position, concentrating on sustaining profitable niche goods in the industrial control industry rather than chasing bigger shipping numbers. GIGABYTE, on the other hand, profited from the gaming sector and maintained its ninth-place shipment market share and ranking.

The top five SSD channels accounted for approximately 60% of the market in 2022 and will only get bigger

Furthermore, significant production reductions by NAND flash suppliers caused the overall market position to rapidly improve by the end of the third quarter. SSDs were the first to reflect the cost hikes, which benefited module manufacturers with lower cost stocks. Significant market volumes and financial resources enabled large SSD sales channels to effectively adapt to industry variations and seize market opportunities. According to TrendForce, these sizable SSD companies will only see further expansion in the upcoming years.

Notwithstanding obstacles in the industry, the top five SSD manufacturers saw a rise in their combined market share in 2022, from 53% to 59%. Throughout 2023, module manufacturers have been steadily lowering high-cost inventory pressures by continual buy smoothing, positioned themselves favorably for price-competitive shipping, even in the face of limited notebook and desktop shipments and a still faltering global economy.

Additionally, significant production reduction by NAND Flash suppliers resulted in a quick turnaround in the overall market sentiment at the end of the third quarter. SSDs initially reflected cost rises, which helped those module producers with lower-cost inventory. Market ups and downs have been effectively navigated and opportunities have been seized by large-scale SSD channels that have significant market volumes and financial resources. According to TrendForce, these sizable SSD companies will only get larger over time.

SSD companies and PCle master controller technologies made in China are quickly catching up

With increasingly sophisticated PCIe control technologies, Chinese domestic PCIe master control companies, such Maxio Technology, are quickly catching up technologically. They are rapidly moving into PCIe 5.0 product development and verification in addition to mass-shipping mainstream PCIe 4.0 devices that are compatible with different NAND Flash providers.

It is anticipated that China’s independent control ICs and module manufacturers would continue to work closely together. In response to a volatile market in recent years, domestic Chinese SSD channels are also aggressively developing supply chain arrangements in an effort to expand internationally. Longsys is at the forefront of this movement, having recently acquired shares in Licheng Suzhou and Smart Modular in Brazil in order to bolster downstream module production capacity.